Discover, compare, and connect with the world’s best financial and payment service providers. From payment gateways to crypto exchanges – find the perfect solution for your business.

Listed Companies

Categories

User Reviews

Countries

Trusted by thousands of businesses worldwide

All companies go through our verification process to ensure authenticity

Get insights from industry experts and real

user experiences

Find the perfect fintech solution with our advanced search filters

Our comprehensive rating system helps you make informed decisions. We evaluate companies based on market research, regulatory compliance, customer feedback, financial stability, and many other factors.

Trusted, stable, and highly regulated

Some risk factors present, monitored closely

High risk, speculative, proceed carefully

Discover why thousands of businesses and professionals choose TheFinRate as their trusted fintech directory platform

All companies go through our comprehensive verification process

50,000+ members from 170+ countries

trust our platform

Connect with financial service providers from around the globe

Real user reviews and expert ratings help you make informed decisions

Get valuable market data and industry

trends analysis

Advanced search filters and detailed

company profiles

Stay updated with the latest fintech industry developments

Buy now, pay later (BNPL) giant Klarna has officially launched its debit card across Europe. This move gives consumers more…

UK digital bank Zopa has made a significant move to expand its payments capabilities by acquiring Rvvup, a provider of…

HSBC UK has launched a new feature for its credit card customers. This service allows eligible users to pay for…

India INX, officially known as India International Exchange (IFSC) Limited, is India’s first international stock exchange. It was established in January 2017 at the International Financial Services Centre (IFSC) in GIFT City, Gujarat, as a wholly owned subsidiary of the Bombay Stock Exchange (BSE). Inaugurated by Prime Minister Narendra Modi, the exchange is designed to serve as a global trading hub offering world-class infrastructure, regulatory efficiency, and competitive costs. Vision & Objective India INX aims to become a leading international financial marketplace by combining cutting-edge technology with product innovation. Its primary focus is to provide global investors with seamless access to diverse asset classes in a highly secure, tax-efficient, and technologically advanced trading environment. Trading & Technology Highlights Extended Trading Hours: India INX operates 22 hours a day, six days a week, enabling investors from different time zones to participate with ease. Ultra-Fast Execution: With a response time of just 4 microseconds, India INX is one of the fastest trading platforms in the world. Cost Efficiency: By adopting open-source technology, the exchange has significantly reduced its operational costs, making trading more affordable for participants. Robust Infrastructure: Built on a tier-III equivalent data center with colocation facilities, India INX uses its proprietary Bolt+ on Web trading platform to provide transparent, reliable, and low-latency execution. Product Portfolio Derivatives: India INX offers trading in index derivatives such as India 50 and BSE Sensex in USD, along with single stock futures and options covering more than 175 underlying instruments. Commodities: The exchange lists contracts in gold, silver, aluminium, copper, nickel, zinc, lead, and crude oil, including innovative products like Gold Quanto and Silver Quanto futures. Currency Derivatives: Products include USD-INR, EUR-USD, GBP-USD, and other currency pairs, with both monthly and weekly contracts available to meet global investor demand. Debt Securities: Through its Global Securities Market platform, India INX provides a platform for the issuance and listing of Masala bonds, green bonds, and foreign currency-denominated bonds, making it a strong competitor to global debt listing hubs. Indices: Custom indices such as India INX 50, Quality 30, Bankex, Midcap, IT, Pharma, Energy, Infrastructure, and Small Cap are available for benchmarking and derivatives trading. USD-Denominated Sensex Derivatives: Introduced to attract wider international participation and enhance market integration. Market Growth & Milestones India INX quickly gained momentum after its launch in 2017, crossing significant trading volume milestones within just a few years. The exchange has recorded peak daily turnovers exceeding USD 30 billion and continues to expand its average daily turnover consistently. Its Global Securities Market has become a preferred platform for international debt listings, hosting billions of dollars worth of securities, including green and sustainable bonds. Competitive Advantages Tax Benefits: Investors enjoy exemptions from securities transaction tax, stamp duty, GST, dividend distribution tax, and capital gains tax. Additional benefits include graded income tax holidays and subsidies on infrastructure investments. Regulatory Support: Established under India’s first IFSC, the exchange operates in a well-regulated environment with globally comparable standards. Global Connectivity: India INX serves as a gateway for global investors to access Indian financial markets while enabling Indian companies to raise capital in international currencies. Cost Competitiveness: Its innovative use of technology ensures some of the lowest transaction costs among global exchanges. Summary India International Exchange (India INX) is a landmark initiative that puts India on the global financial map. By combining speed, efficiency, extended trading hours, and cost competitiveness, it offers global investors access to a diverse range of asset classes—from derivatives and commodities to currencies and debt securities. With its foundation in GIFT City and strong backing from the BSE, India INX is positioned as a world-class international exchange for the future of global trading.

Marketing for Tradies—Lead Generation That DeliversFrom websites and SEO to Google Ads and social media, Tradie Digital is your specialist partner in digital growth—backed by a $300 lead increase guarantee and no lock-in contracts. About Us Founded in 2013, Tradie Digital has delivered over $200 million in leads to trades businesses across 200+ trade industries, from bathroom renovators and landscapers to stone benchtop installers.Our mission is bold: to deliver $1 billion in leads to tradies by 2026—so whether you’re on the tools, managing a team, or scaling operations, we make growth simple. What Sets Us Apart Real Tradie ExperienceOur CEO, Carl, is a former tradie who knows the entrepreneurial grind—balancing tools, paperwork, customer service, and staffing. We speak your language, not marketing jargon. $300 Lead Increase GuaranteeSwitch your marketing to us, and if your leads don’t improve—we’ll pay you $300. Zero Contracts, Zero WorriesWe believe in results, not lock-in contracts. You stay because we deliver—not because binding terms say you must. Results-Driven & TransparentEverything we do—strategy, SEO, ads, site changes—focuses on ROI. We keep our processes clear and honest, always. Trade-Exclusive FocusFrom tilers to concreters and turf layers to renovators, we work only with trade businesses—so our strategies are 100% tailored for you. Free Consultation (Valued at $495)Jumpstart your digital strategy with a no-cost consultation that’s all about maximizing your growth. Our Services Websites That Work for You DIY WebsitesBuild your own with Pedestal’s trade-specific templates in 1–2 hours—no code, no hassle. “We Build It For You” WebsitesSend your assets—logo, images, content—and we’ll deliver a high-converting website in under 7 days—or it’s free. Custom WebsitesFully bespoke builds, optimized from the ground up with conversion-driven design and keyword mapping to attract qualified traffic. Digital Marketing That Moves the Needle Tradie SEOLocal SEO strategies tailored for tradies, optimizing for mobile, speed, architecture, and link building. Aim for the top of Google’s local rankings where clicks (and customers) matter. Google AdsCapture high-intent leads fast with PPC—plus our $300 increase guarantee applies here too. Social Media Marketing & MoreExpand your visibility across platforms with targeted, lead-focused social campaigns. Proven Success & Case Studies “Doubled His Business” — Ecolawns Australia’s Aaron Zarb turned to us after being burned by other agencies—and achieved transformative growth. Other clients have reported up to 275% lead increases through our targeted strategies. Our Values Entrepreneurial BackboneWe champion the spirit of small business owners—the backbone of our communities. Play to WinSecond place isn’t an option. We obsess over helping you win in your marketplace. Culture-DrivenA passionate, aligned team means better work and better outcomes for you. Transparency & ROINo hidden fees. No jargon. Just honest strategies that make your business more profitable. Social ImpactWe support global entrepreneurship through donations to Kiva.org—when you work with us, you’re helping more than just your trade business.

Corp Legex is a distinguished full-service law firm, founded by partners with decades of collective experience. The firm offers comprehensive legal services to both domestic and international corporate clients, with a strong foundation in integrity, excellence, and client satisfaction. Its leadership brings together professionals holding dual qualifications—commonly as lawyers combined with credentials like Chartered Accountant or Company Secretary—enabling a holistic and pragmatic approach to complex legal matters. Core Practice Areas Corp Legex delivers expertise across a wide spectrum of corporate and regulatory domains, including: Mergers, Acquisitions & Transactional Advisory Insolvency, Restructuring & Corporate Recovery Data Privacy and Protection Dispute Resolution, Litigation & Arbitration Corporate and Regulatory Compliance Capital Market Advisory Banking and Finance Intellectual Property Tax Advisory and Litigation Securities Law FEMA and NBFC regulation Support for Startups and MSMEs Family Settlement & Succession Planning Private Equity Environmental, Social, and Governance (ESG) advisory Unique Strengths Integrated Expertise: With dual-qualified professionals, the firm offers legally sound advice with deep financial and secretarial insight. Client-Centric Approach: Emphasis on transparent, responsive communication ensures clients remain informed and confidently guided through every stage of their legal journey. Proven Leadership: Corp Legex launched as a boutique firm with ten seasoned partners, supported by a three-member advisory board and nearly 20 associates. Dynamic and Evolving: Established in 2022, the firm has quickly made a name for itself as an innovative and dependable legal partner. Leadership Highlight The founding and managing partner, Suman Kumar Jha, brings over 12 years of rich experience in areas such as mergers and acquisitions, corporate restructuring, insolvency, joint ventures, fintech, and corporate disputes. His unique mix of strategic insight and business acumen, combined with a robust background in finance and corporate law, enables tailored, risk-focused solutions. He is also a frequent speaker at governmental and industry seminars, further underlining his expertise and influence. Locations Corp Legex serves clients through strategic offices across major Indian business hubs: Noida (Delhi-NCR) Chandigarh Bengaluru Culture & Commitment Corp Legex is deeply committed not only to delivering exceptional client service but also to the professional growth of its team. The firm fosters a culture of continuous learning, collaboration, and innovation, keeping pace with legal developments and industry best practices. This ensures resilient client outcomes and sustained professional excellence. Why Choose Corp Legex? Strength Description Multi-disciplinary expertise Merges legal, financial, and secretarial insights into tailored solutions. Client-first orientation Offers transparent, prompt, and personalized legal guidance. Established leadership Led by an experienced founding partner and a distinguished advisory team. Focused growth & innovation A modern, dynamic boutique with rapid trajectory since its inception. Geographic accessibility Offices in key Indian metropolitan centers ensure seamless client access. Conclusion Corp Legex (Advocates & Solicitors) positions itself as a trusted, sophisticated legal partner for corporate entities navigating complex transactions, regulatory environments, and restructuring. With its blend of academic rigor, practical insight, and client-first values, the firm stands ready to deliver informed, strategic, and efficient legal solutions.

The Institute of International Finance (IIF) is the premier association representing the global financial services industry. Founded in 1983 by a group of 38 leading banks in response to the international debt crisis, it has since expanded to include approximately 400 to over 450 institutions across more than 60 countries, including commercial and investment banks, asset managers, insurance companies, sovereign wealth funds, hedge funds, central banks, and development banks. The IIF is headquartered in Washington, D.C., and maintains offices in strategic global financial centers. Mission and Purpose IIF’s mission is to support the financial industry in managing risks prudently, establishing sound industry practices, and advocating for regulatory and economic policies that promote global financial stability and sustainable economic growth. It achieves this through its research, advocacy, and convening of industry leaders. Core Offerings Research and Data Insights The IIF is a trusted independent source of global economic and financial research, with a strong focus on emerging economies and international market developments. Its research covers macroeconomic trends, capital and portfolio flows, risk assessments, policy challenges, and sector-specific analysis. Members benefit from frequent publications and access to comprehensive, high-frequency databases. Advocacy and Policy Engagement The IIF plays a leading role in global financial regulation and policy discourse. It engages constructively with policymakers, regulators, and global standard-setters, offering thought leadership, formal submissions, and participation in high-level forums to shape regulatory frameworks in the interest of industry stability and growth. Convening Power Through high-profile events—including webinars, roundtables, forums, and annual meetings—the IIF creates platforms for dialogue among its members, policymakers, and international stakeholders. These gatherings serve as crucial venues for discussing trends in digital finance, sustainability, debt, risk, and crisis preparedness. Member Services and Engagement Members gain access to customized briefings by expert economists and capital markets analysts, data insights, thematic publications, and virtual investor trips to emerging markets. This tailored support helps institutions anticipate challenges, inform strategy, and stay ahead of developing trends. Leadership and Governance The IIF is governed by a board of directors comprising leading figures from across the financial industry. As of the latest information, the President and CEO is Timothy D. Adams (in office since February 2013), and the board is chaired by Ana Botín, supported by vice chairs across banking and insurance sectors. This leadership team ensures the Institute remains aligned with industry priorities while upholding excellence and independence. Global Reach and Influence With a membership from developed and emerging markets spanning the globe, the IIF provides a uniquely holistic view of international finance. Its presence in financial centers across continents reinforces its capacity to offer insights, influence global financial agendas, and foster cross-border collaboration. Impact and Relevance The IIF’s work influences how financial policies are shaped, risks are managed, and global financial systems evolve. Its research informs decision-making, its advocacy molds frameworks for stability, and its convenings bring together diverse stakeholders to navigate complex economic landscapes. Why IIF Stands Out Feature Description Global Representation Covers institutions from major financial markets and emerging regions Expert Research Offers rigorous analysis on macro trends, capital flows, and emerging risks Policy Influence Shapes regulation through constructive engagement and thought leadership Networking Platform Hosts events that connect industry leaders and decision-makers globally Tailored Insights Provides specialized briefings and data support to guide member strategies Conclusion The Institute of International Finance remains a vital institution in the global financial ecosystem. By blending rigorous research, policy advocacy, and high-level convenings, it supports the industry’s ability to adapt, grow, and sustain stability in an ever-changing economic environment. For professionals and organizations looking to understand, influence, or navigate the global financial landscape, the IIF is an indispensable resource.

TaxGuru is a leading online portal dedicated to providing timely and authoritative updates in taxation, corporate law, finance, and more. Established with a mission to empower professionals, TaxGuru offers expert insights and resources specifically tailored for Chartered Accountants, Company Secretaries, Cost Accountants, tax practitioners, legal professionals, and finance students. Core Content and Coverage TaxGuru publishes well-researched articles and news across a comprehensive range of subjects, including: Income Tax – covering key rulings, filing guidance, notifications, circulars, and judicial interpretations. Goods and Services Tax (GST) – offering insights into rate changes, government communications, case law, and compliance. Corporate and Company Law – discussing emerging regulations, board-level developments, filings, and governance updates. Service Tax, Customs, Excise, Finance, RBI, SEBI, DGFT – featuring news, regulatory dynamics, and updates across these specialized spheres. Budget Commentary – detailed analysis of annual budget announcements from recent years, helping readers understand policy shifts and their implications. Professional Updates for CA / CS / CMA – articles, regulatory news, legal pronouncements, and practical guidance for professional certification holders. This rich and sector-diverse content empowers professionals to stay current with evolving laws, procedural changes, and legal interpretations. Featured Sections and Tools TaxGuru’s platform is thoughtfully organized into sections such as Latest Articles, Latest News, Judiciary Updates, and Notifications. It also includes user-friendly features like: Downloads and Calculators – Excel templates, compliance charts, financial tools, and tax calculators. FAQs – curated answers on topics like incentives, MSME scheme provisions, dividend regulations, and tax assessments. Interactive Community – a platform where users can comment, ask questions, and engage with authors and peers. Content Categorization – intuitive tagging of Featured Posts, Trending Posts, Popular Posts, and section-wise navigation for easy discovery. These resources make TaxGuru both a research hub and a practical toolkit for daily professional use. App and Accessibility TaxGuru extends its content experience through mobile applications on Android and iOS, offering on-the-go access to its complete offerings. The apps feature a clean interface, are regularly updated, and support features similar to the website—including news, articles, tools, and offline capabilities. Why Professionals Choose TaxGuru Expert Authorship – Content is developed by seasoned professionals with deep domain knowledge and practical experience. Scope and Depth – Detailed coverage of multifaceted topics ranging from taxation and company law to foreign trade and regulatory updates. Timeliness and Accuracy – Reliable and up-to-date dissemination of regulatory changes, legal judgments, and budget developments. Supportive Tools – A variety of downloads, FAQs, and calculators that streamline research and compliance workflows. Community Learning – An engaging platform where professionals can share insights, ask questions, and learn from peers. Mission and Impact Built on the foundational belief that “knowledge is power,” TaxGuru seeks to enhance understanding and competency in complex regulatory domains. By simplifying legal frameworks and amplifying professional awareness, it supports both seasoned practitioners and aspiring professionals in navigating India’s evolving tax and corporate environments.

The International Finance Corporation (IFC) is the private-sector arm of the World Bank Group, founded in 1956. It is the world’s largest development institution dedicated exclusively to promoting private-sector investment in emerging and developing economies. Headquartered in Washington, D.C., IFC works across more than 100 countries to reduce poverty, create jobs, and build sustainable opportunities by mobilizing private capital and expertise. Mission and Vision IFC’s mission is to leverage the power of the private sector to end extreme poverty and boost shared prosperity. Its vision is to create markets and opportunities where they are most needed, ensuring inclusive and sustainable growth in developing regions. By providing capital, advisory services, and expertise, IFC transforms innovative ideas into projects that deliver measurable development impact. Core Services Financing Solutions Loans and credit lines for private-sector businesses Equity financing to support long-term growth Risk-sharing instruments and guarantees to reduce barriers to investment Advisory Services Strategic advice for companies and governments Risk management, operational efficiency, and corporate governance guidance Support in regulatory reform and market-building Asset Management Mobilizing third-party capital through investment funds Expanding the reach of development finance beyond IFC’s own balance sheet Blended Finance Combining concessional and commercial capital Unlocking high-impact projects that may otherwise remain underfunded Strategic Focus Areas IFC focuses on addressing global development challenges by prioritizing: Investment in frontier markets, including fragile and conflict-affected regions Climate solutions and environmental sustainability initiatives Development of essential infrastructure, healthcare, and education systems Strengthening food security and agricultural value chains Expanding inclusive financial markets for micro, small, and medium-sized enterprises Supporting women entrepreneurs and fostering gender equality Governance and Accountability As a member of the World Bank Group, IFC operates with its own governance framework, legal agreements, and management structure. It maintains strong accountability through independent evaluation units, transparency in reporting, and global standards for responsible investment. Its environmental and social guidelines are widely recognized as benchmarks for sustainable business practices. Global Reach and Impact IFC works in more than 100 countries, delivering financial and advisory support to businesses and governments. It collaborates with private investors, development institutions, and local partners to amplify its impact. In recent years, IFC has mobilized record levels of capital for private-sector development, supporting initiatives in clean energy, infrastructure, digital connectivity, and small business finance. Development Impact IFC’s investments and advisory programs have contributed to: Creation of millions of jobs in emerging markets Expansion of financial access for underserved communities Increased electricity and internet connectivity in developing regions Strengthening of businesses and industries that drive local economies Advancement of climate-friendly and sustainable projects Commitment to Sustainability IFC has established global standards for environmental and social responsibility. Its frameworks encourage responsible investments that balance growth with long-term sustainability. Initiatives such as energy-efficient building certifications, green financing instruments, and support for renewable energy demonstrate IFC’s commitment to combating climate change while fostering inclusive economic development. Recent Highlights IFC has expanded investments in sustainable infrastructure, clean energy, and digital transformation to accelerate inclusive growth in developing countries. It has mobilized billions in private-sector funding to support climate resilience, biodiversity, and social impact projects across Africa, Asia, and Latin America. In India and other emerging economies, IFC has actively supported innovation in electric mobility, agritech, and financial inclusion. Why IFC Matters Global Credibility: As part of the World Bank Group, IFC is a trusted partner for governments, businesses, and investors. Expertise and Innovation: IFC’s tailored solutions address diverse industry and regional challenges. Sustainable Growth: Its investments are designed to deliver measurable social, economic, and environmental impact. Inclusive Development: By supporting SMEs, women entrepreneurs, and underserved markets, IFC creates opportunities for all. Resilient Markets: IFC helps strengthen local economies, making them more resilient to global shocks. Conclusion The International Finance Corporation plays a pivotal role in advancing private-sector development, driving sustainability, and creating opportunities in emerging markets. By combining capital, expertise, and global standards, IFC continues to shape inclusive growth and deliver lasting impact across the world.

Welcome to the BSE Listing Portal Your gateway to India’s premier capital-raising platform, backed by the legacy and trust of BSE Limited — Asia’s oldest stock exchange. The portal provides a transparent, efficient, and reliable framework for companies to list and grow in the capital markets. About BSE Founded in 1875, BSE has been a pioneer in shaping India’s financial ecosystem. It offers one of the fastest electronic trading platforms in the world and has built a reputation for transparency, trust, and innovation. Today, BSE stands as a symbol of credibility, helping companies unlock opportunities and investors build wealth. Why Choose BSE for Listing Credibility and Reach A listing with BSE enhances your organization’s reputation, improves visibility, and connects you with a broad investor base across the nation. Strong Governance Framework BSE maintains strict regulatory standards, ensuring adherence to corporate governance, disclosure requirements, and compliance for all listed entities. Diverse Market Options BSE offers both the Main Board and SME platforms, enabling companies of all sizes and growth stages to raise capital and access investors. Efficient Processes With its advanced online systems, BSE ensures a streamlined, transparent, and timely listing process, providing confidence to both issuers and investors. The Listing Journey Choose the Right Platform – Companies may opt for the Main Board or the SME Exchange depending on their size and growth stage. Eligibility Check – Businesses must meet basic financial and regulatory criteria, ensuring credibility before entering the market. Appoint a Merchant Banker – A key partner who conducts due diligence, prepares documents, and manages the listing process. Documentation and Review – Submission of required documents such as financial statements, resolutions, and compliance reports for verification. Approval and Listing – On meeting all requirements, the company receives approval, paving the way for public issue and trading commencement. Benefits of Listing at BSE Market Visibility – Gain recognition and trust through association with one of India’s most respected exchanges. Liquidity for Investors – Shares become easily tradable, encouraging wider investor participation. Valuation and Transparency – Public listing ensures fair valuation and price discovery. Access to Capital – Enables companies to raise funds efficiently for expansion and growth. Enhanced Corporate Image – Strengthens brand reputation and investor confidence. Get Started Today The BSE Listing Portal is designed to simplify your capital market journey. Whether you are an emerging SME or a large enterprise, BSE provides the platform, processes, and credibility needed to grow with confidence.

GIFT City (Gujarat International Finance Tec-City) is India’s pioneering greenfield smart city and the country’s first International Financial Services Centre (IFSC)—designed as a global benchmark for financial and technological innovation Vision & Strategic Mission GIFT City was conceptualized with the ambition to serve as a world-class hub for finance and IT—offering seamless services across borders and enabling Indian firms to thrive on a global level The project is driven by core values such as sustainability, inclusivity, excellence, and transparency Location & Connectivity Nestled between Ahmedabad (business epicentre) and Gandhinagar (political capital), GIFT City forms the nucleus of the region’s “tri-city” ecosystem. It enjoys robust external connectivity: Just 20 minutes from Ahmedabad Airport Situated along NH-48 (Delhi–Mumbai Industrial Corridor) Connected via the Ahmedabad Metro World-Class Infrastructure GIFT City boasts cutting-edge urban infrastructure and sustainable technology: India’s first Platinum-rated greenfield smart city District Cooling System (energy efficient by 30–40 %) Underground utility tunnels (ensuring minimal disruptions) Zero-discharge water system and automated waste managemen IFSC & Business Environment GIFT City’s International Financial Services Centre sets the stage for cross-border finance through a separate regulatory and tax framework: Governed by the unified IFSCA (integrating RBI, SEBI, IRDAI, PFRDA oversight) Offers incentives such as tax holidays, exemptions from GST, stamp duty, securities/commodity transaction taxes, capital gains tax, and customs duties Economic Ecosystem & Key Stakeholders With over 550 operational entities across 22 million sq ft, GIFT City is a thriving economic zone with $20 billion in committed investments and more than 20,000 jobs generated It attracts major global players—HSBC, Bank of America, Morgan Stanley, Infosys, Wipro—alongside a dynamic mix of fintech firms, capital market participants, Alternative Investment Funds, and IT/ITES companies Talent & Innovation Ecosystem Positioned within Gujarat’s knowledge corridor, GIFT City enjoys unrivalled access to top-tier talent and academic institutions: Nearby institutions include IIT Gandhinagar, IIM Ahmedabad, NIRMA University, GNLU, MICA, NID, CMU, and international campuses like Deakin University and University of Wollongong Supported by Gujarat’s engineering and IT talent pool—over 100,000 engineering graduates and 50,000 IT/ITES professionals yearly Business Advantages For Global Capability Centres (GCCs): Designed for transformation: from back-office setups to innovation hubs Ultra-modern infrastructure matched with supportive policy incentives Strong regional talent supply aligned with national and state GCC promotion policies For Financial & Tech Enterprises: Regulatory and tax incentives tailored for rapid scaling Eco-efficient operations with cost savings averaging 20–50 % vs. other global financial hubs Gateway to strategic sectors such as bullion, fintech, aviation & shipping, pharmaceuticals, auto — leveraging established clusters in Gujarat Ranking & Global Recognition Global Financial Centres Index (GFCI 37, 2025): Top rank in reputational advantage 40th in fintech Overall 46th globally Previously ranked 10th in finance and leading among emerging financial centre. Summary GIFT City stands at the intersection of sustainable urban development and global finance. Its unmatched infrastructure, regulatory clarity, strategic positioning, and talent ecosystem make it a standout destination for businesses seeking innovation, efficiency, and global growth. Whether you’re a fintech pioneer, GCC entrant, or financial institution, GIFT City isn’t just a location—it’s your gateway to global excellence.

About Masung Founded in 2006, Masung is a pioneering force in the self-service equipment industry, known for its specialization in POS devices, embedded printers, scanners, and customizable OEM/ODM solutions. Headquartered in Shenzhen and Changsha, China, Masung operates with a strong focus on research and development, supported by a top-tier talent pool and cutting-edge infrastructure. Infrastructure & Capabilities With a 4,000 sq. meter office and a 40,000 sq. meter production area, Masung manages the entire production lifecycle in-house — from SMT and assembly to final product testing. The company holds over 200 patents and proudly owns 100% of its product intellectual property. Masung’s products are backed by ISO9001:2015 certification and comply with CCC, CE, ROHS, FCC, UL, and other international standards — ensuring unmatched quality and reliability across its offerings. Key Offerings Self-service kiosks and equipment Embedded printers and scanners POS devices and modules OEM/ODM end-to-end manufacturing services Why Choose Masung? Proven Innovation with 200+ Patents:Masung owns the full intellectual property rights to its products, backed by more than 200 patents. This ensures clients receive original, future-ready technology that stands out in the market. Certified Quality You Can Trust:Every Masung product is built to meet international standards, including ISO9001:2015, CE, ROHS, FCC, UL, and CCC certifications—making them reliable for global markets and enterprise deployment. Complete In-House Manufacturing:From SMT and assembly to rigorous testing, Masung controls the entire production lifecycle. This results in faster turnaround, consistent quality, and flexible customization options. Strong Focus on Research & Development:With dedicated R&D facilities and a skilled engineering team, Masung continuously upgrades its technologies to meet changing business needs and emerging market demands. Flexible OEM/ODM Services:Whether you need private label branding or fully customized hardware solutions, Masung provides comprehensive OEM/ODM support to help your business scale efficiently. Global Clientele & Scalable Solutions:Trusted by businesses worldwide, Masung’s solutions are scalable and adaptable across industries such as retail, transportation, finance, healthcare, and more. Business Details: Founded: 2006 Headquarters: Shenzhen, China Employee Count: 201–500 Website: https://npprinter.com Email: masung.group@gmail.com Phone: +86 133 8078 8384 Contact Person: Tom

Explore trusted payment gateway providers worldwide. Compare solutions, reviews, and ratings for seamless global transactions.

Discover leading digital banks offering innovative fintech services. Compare features, security, and customer experiences for smarter banking.

Browse trusted crypto exchanges globally. Verified listings with ratings and reviews to help you trade and invest with confidence.

Find reliable AML & KYC compliance providers. Trusted partners for fraud prevention, risk management, and regulatory adherence.

Explore top RegTech innovators simplifying compliance. Compare providers delivering automated solutions for seamless management.

Compare trading platforms for forex, CFDs, and stocks. Verified solutions with user reviews to guide smarter trading decisions.

Discover global acquiring service providers. Compare rates, reliability, and reviews to grow your business with trusted partners.

Browse specialized fintech legal service providers. Verified firms for compliance, licensing, and cross-border financial regulations.

Devcom 2024 Date: August 18-19, 2024. Location: Koelnmesse, Cologne, Germany Website: Devcom 2024 Overview: Devcom 2024 is the premier game…

TRANSACT 2025 Event Date: April 2-4, 2025 Event Location: Las Vegas, USA Event Description: TRANSACT 2025 is the leading payments event…

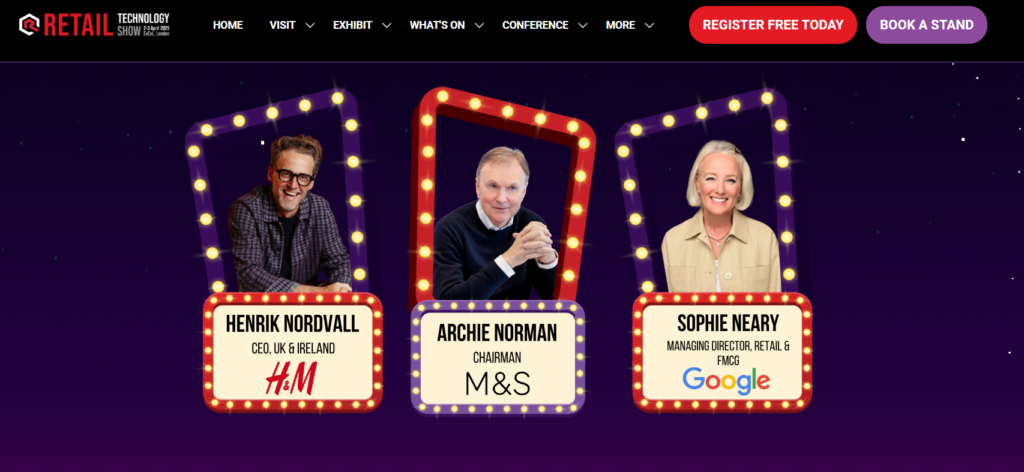

Retail Technology Show 2025 Event Date: April 2-3, 2025 Event Location: ExCeL London, UK Event Description: Retail Technology Show (RTS2025)…

Expert insights and industry knowledge at your fingertips

N26, Germany’s leading digital bank, has undergone a major leadership shake-up. This article explores why these changes matter and how…

Solana Cross-Border Payments are transforming how money moves globally—fast, affordable, and built for scale. Its rise marks a new chapter…

Global fintech deals slowed to $182M across 15 rounds. The fintech summer slowdown may not be a seasonal dip but…

Paymentus is outpacing Visa and Mastercard on the stock charts, but can its cloud-driven, bill-payment focus deliver sustainable growth?

India’s digital lending boom is reshaping credit access. Can RBI balance innovation with regulation to unlock inclusion without stifling growth?

Indian traders are rapidly shifting from spot markets to crypto futures. Lower tax burdens, high leverage, and global alignment are…