1. Initial Setup Costs:

- Offshore Accounts: Initial setup costs can be higher due to registration fees, legal consultations for international laws compliance, and potential currency exchange fees.

- Domestic Accounts: Typically have lower initial setup costs since they operate within the country’s regulatory framework.

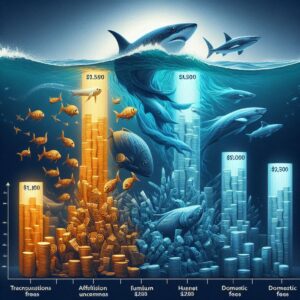

2. Transaction Fees:

- Offshore Accounts: Transaction fees may vary widely based on the jurisdiction and the risk profile of the business. Additional fees for currency conversion and cross-border transactions are common.

- Domestic Accounts: Transaction fees are generally lower and more predictable, with fewer currency exchange issues.

3. Processing Fees:

- Offshore Accounts: Processing fees can be higher to mitigate the risk associated with high-risk businesses and international transactions.

- Domestic Accounts: Lower processing fees due to reduced risk and simpler regulatory compliance requirements.

4. Chargeback Management:

- Offshore Accounts: Handling chargebacks can be more complex and costly due to international regulations and differing legal frameworks.

- Domestic Accounts: Easier and cheaper chargeback management processes with clear jurisdictional rules.

5. Reserve Requirements:

- Offshore Accounts: Often require higher reserve percentages to cover potential risks associated with international transactions and high-risk businesses.

- Domestic Accounts: Lower reserve requirements due to local regulatory protections and familiarity with domestic market risks.

6. Compliance Costs:

- Offshore Accounts: Higher compliance costs due to adherence to multiple jurisdictions’ regulations, requiring legal and consulting expenses.

- Domestic Accounts: Lower compliance costs with a single regulatory framework to navigate.

7. Risk and Security:

- Offshore Accounts: Higher perceived risk due to potential legal and regulatory challenges, which may affect business continuity.

- Domestic Accounts: Lower risk profile with better legal protections and security measures.

8. Customer Perception:

- Offshore Accounts: Some customers may perceive offshore transactions as less secure or reliable, affecting trust and conversion rates.

- Domestic Accounts: Generally, customers trust domestic transactions more, leading to potentially higher conversion rates.

Conclusion: Choosing between offshore and domestic merchant accounts for high-risk payment processing involves weighing upfront costs, ongoing transaction fees, compliance requirements, and risk mitigation strategies. While offshore accounts may offer lower initial fees, they often come with higher operational costs and regulatory complexities. Domestic accounts, though initially more expensive, provide greater stability, lower transaction costs, and better customer trust.