QR code payments have emerged as one of the most convenient and efficient methods for making cashless payments, used by everyone from street vendors to luxury stores. Unlike traditional methods, QR codes make it possible to initiate payments with a simple scan, minimizing the need for physical cards, cash, or even close-range technologies like NFC. This guide explores how QR code payments work, their advantages, security, and why they’re quickly gaining traction.

What is a QR Code Payment?

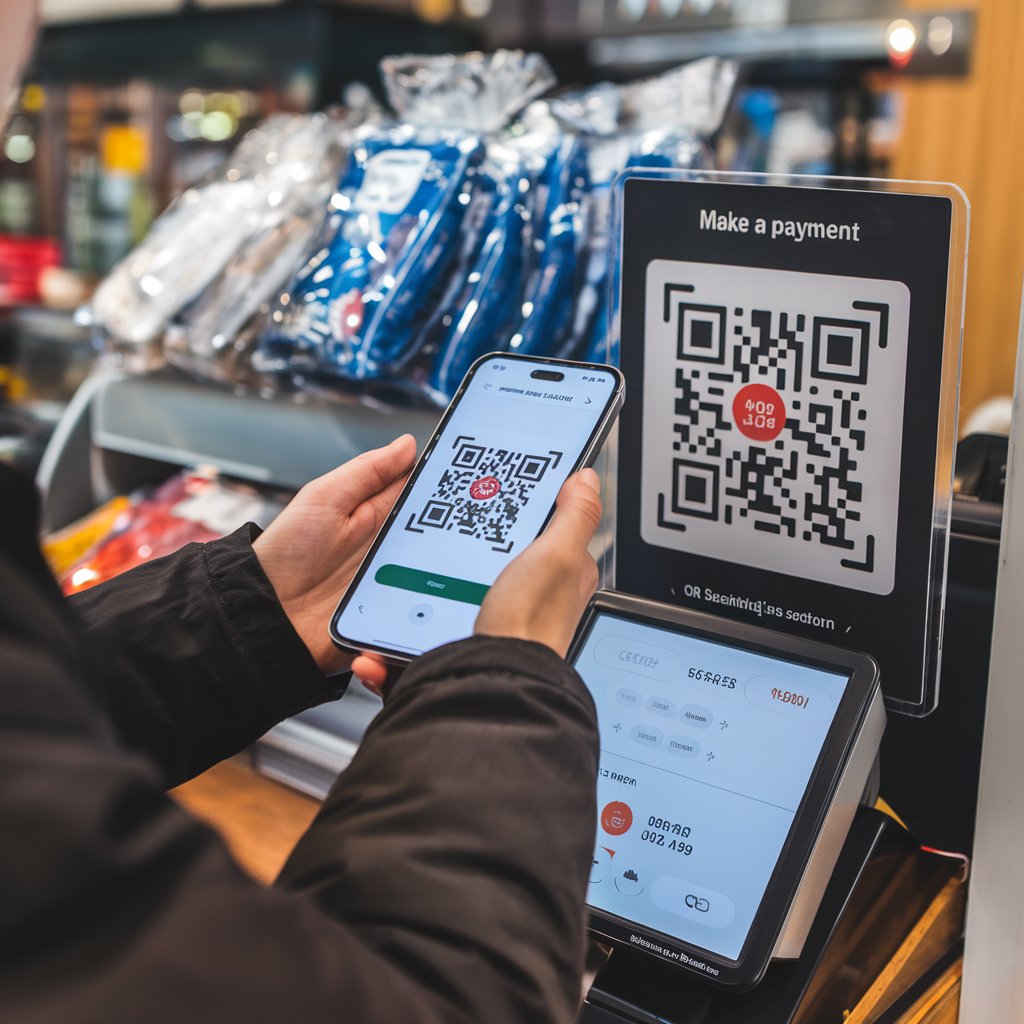

A QR (Quick Response) code payment is a cashless method that allows customers to pay by scanning a code displayed by the merchant, either on a screen, printed material, or a terminal. QR codes contain encoded information—often in the form of a URL or payment details—which instantly directs the customer to a payment page.

Unlike static barcodes, which can only store information in a single dimension, QR codes are two-dimensional and can hold more data. This makes them ideal for payment applications, where they can contain everything needed for a transaction.

Step-by-Step: How QR Code Payments Work

There are two main types of QR code payments: customer-presented and merchant-presented. Here’s a breakdown of each process:

- Customer-Presented Mode

In this method, the customer generates a QR code on their mobile banking or digital wallet app and presents it to the merchant for scanning.

- Step 1: Open Payment App

The customer opens a digital wallet or banking app capable of generating a QR code for payments. - Step 2: Generate QR Code

The app generates a unique QR code containing the necessary payment information, including the customer’s account details (encoded securely) and transaction amount. - Step 3: Merchant Scans Code

The merchant uses a scanner or smartphone to scan the QR code. - Step 4: Transaction Processing

The scanned data is transmitted to the payment processor, which verifies the details and authenticates the payment. - Step 5: Confirmation

Both customer and merchant receive a confirmation of the transaction, either through the app or a printed receipt.

- Merchant-Presented Mode

Here, the merchant presents a QR code that the customer scans with their mobile device to initiate payment.

- Step 1: Display QR Code

The merchant displays a QR code either on a screen, a sticker, or even a printed receipt. - Step 2: Customer Scans QR Code

The customer opens their payment app, selects the scan option, and scans the merchant’s QR code. - Step 3: Enter Payment Amount

If the QR code doesn’t contain a pre-set payment amount, the customer enters the amount they wish to pay and confirms the transaction. - Step 4: Transaction Processing

The payment information is transmitted through the app to the payment processor, which authenticates and processes the transaction. - Step 5: Transaction Completion

Both parties receive instant confirmation of the transaction, signaling that the payment was successful.

Core Components of a QR Code Payment

To understand QR code payments more deeply, it’s helpful to break down the core elements:

- QR Code Generator

A QR code is generated by either the merchant or customer app, encoding payment-related data, which may include merchant account details, transaction amounts, or customer IDs. - Payment App or Digital Wallet

Both merchants and customers rely on digital wallets or payment apps to generate, scan, and decode QR codes. Popular examples include Apple Pay, Google Pay, and WeChat Pay. - Payment Processor

This entity verifies the transaction details, manages authentication, and processes the payment between the customer’s and merchant’s accounts. - Acquirer and Issuer

The acquirer (merchant’s bank) and the issuer (customer’s bank) communicate with the payment processor to finalize the transaction.

Why QR Code Payments Are So Popular

- Accessibility and Ease of Use

QR code payments require minimal hardware, as both merchants and customers need only a smartphone and a payment app. This makes them accessible even to small businesses that may not have point-of-sale (POS) systems.

- Low-Cost Setup

Unlike card readers or NFC terminals, QR codes are inexpensive to deploy. Merchants can print QR codes on paper or display them on screens without requiring complex hardware.

- Security Advantages

Since QR code transactions don’t require physical contact, they reduce risks associated with skimming or card cloning. Additionally, all sensitive data is encrypted, minimizing the risk of data theft.

- Contactless Convenience

Particularly in the post-pandemic era, contactless payment options like QR codes have gained traction as they allow customers to complete transactions without physically touching any devices.

- Increased Transaction Speed

QR code payments are fast, with minimal steps needed from the customer and merchant. Transactions are generally completed within seconds, enhancing the overall user experience.

Security in QR Code Payments

While QR code payments are convenient, they come with unique security considerations. Here are some of the main safety mechanisms and risks associated with them:

Encryption and Tokenization

Payment information within a QR code is encrypted, and in many cases, tokenization is used, which substitutes sensitive card data with unique tokens, making it unreadable if intercepted.

Authentication Measures

Many payment apps require biometric verification (such as fingerprint or facial recognition) or PIN entry before completing the payment, adding an extra layer of security.

Risk of Phishing and Fake QR Codes

Fraudsters sometimes create fake QR codes that lead customers to malicious websites. To prevent this, customers should verify that they are scanning legitimate codes from trusted merchants and avoid QR codes that come from unknown sources.

Secure Payment Apps

Reputable payment apps use secure channels to transmit data, ensuring that sensitive information is not exposed during the payment process.

Key Use Cases of QR Code Payments

QR codes are versatile and suitable for a range of industries:

- Retail and E-commerce

Both physical and online retailers use QR codes for quick checkout, with options to print QR codes on receipts or display them on websites. - Food and Beverage

Restaurants and cafes use QR codes to facilitate contactless payment at the table, often integrating them with digital menus for a seamless dining experience. - Transportation and Ticketing

Public transit and ticketing services increasingly use QR codes for quick entry, allowing users to buy and scan tickets directly from their smartphones. - Events and Entertainment

QR codes simplify entry to concerts, festivals, and theaters, with scannable tickets and pre-paid services linked directly to users’ apps. - Peer-to-Peer Payments

QR codes also facilitate peer-to-peer payments, allowing individuals to transfer money by scanning each other’s codes, ideal for splitting bills or sharing expenses.

Limitations and Challenges of QR Code Payments

- Dependence on Smartphones and Apps

Not all customers have access to a smartphone or digital wallet, which can limit the customer base for QR code-only merchants.

- Internet Connectivity Requirements

QR code transactions require a stable internet connection for both the merchant and the customer, which can be a limitation in areas with poor connectivity.

- Risk of Fake Codes and Phishing Attacks

Fake QR codes pose a risk, where fraudsters might place bogus codes over real ones, leading customers to unintended payment links.

Future of QR Code Payments

With their flexibility, ease of use, and cost-effectiveness, QR code payments are likely to expand across more industries. As 5G technology improves mobile connectivity, QR code payments will become even faster, and advancements in security (such as AI-driven fraud detection) will make them safer. In addition, as digital wallets and mobile banking apps continue to proliferate, more people will have access to QR code payments, potentially becoming a global standard in both developed and emerging markets.

Conclusion

QR code payments represent a significant shift in how we conduct transactions, offering a highly accessible, secure, and efficient payment method. With minimal hardware requirements, flexible use cases, and broad accessibility, they are ideal for small businesses, global merchants, and even peer-to-peer transfers. Although challenges like fake QR codes and reliance on smartphones exist, the benefits far outweigh the drawbacks, making QR code payments a promising part of the future cashless economy.