Introduction

India’s used car market is booming — valued at around USD 36.39 billion in 2025 and expected to reach nearly 6 million sales by FY 26 — but financing remains a major barrier for most buyers. While demand for pre-owned vehicles has surged past the new car market in scale, nearly 70 % of used car buyers struggle to access timely and suitable loans due to opaque lending criteria, longer approval times, and fragmented dealer networks.

Enter RupeeDot, a Startup India-recognized fintech platform founded by veteran auto-finance professional Ravish Prasad. The company is building smart, technology-driven financing solutions designed to democratize used car ownership in India — bridging the huge credit gap that has held back consumer demand and early stage dealer growth.

The Used Car Finance Gap: A Massive Opportunity

Despite rapid growth, financing penetration in India’s used car sector remains alarmingly low — below 30 %, compared with nearly 70 % penetration in new car financing.

A mix of manual processes, limited lender visibility, and mismatched applications results in elongated turnaround times and high rejection rates. Many dealers, especially smaller and mid-sized operators, lack the bandwidth to track constantly evolving lender policies, eligibility criteria, documentation norms, and risk-based pricing models. Consequently:

- Buyers face 4–6 day loan approval cycles

- Interest rates on used car loans tend to be 4–5 % higher than for new cars

- RC/RTO transfer delays add friction at the point of sale

This inefficiency creates a significant credit access gap: a majority of used car buyers are either under-served or excluded entirely by formal financial institutions. That’s where RupeeDot steps in.

RupeeDot’s Tech-Led Approach

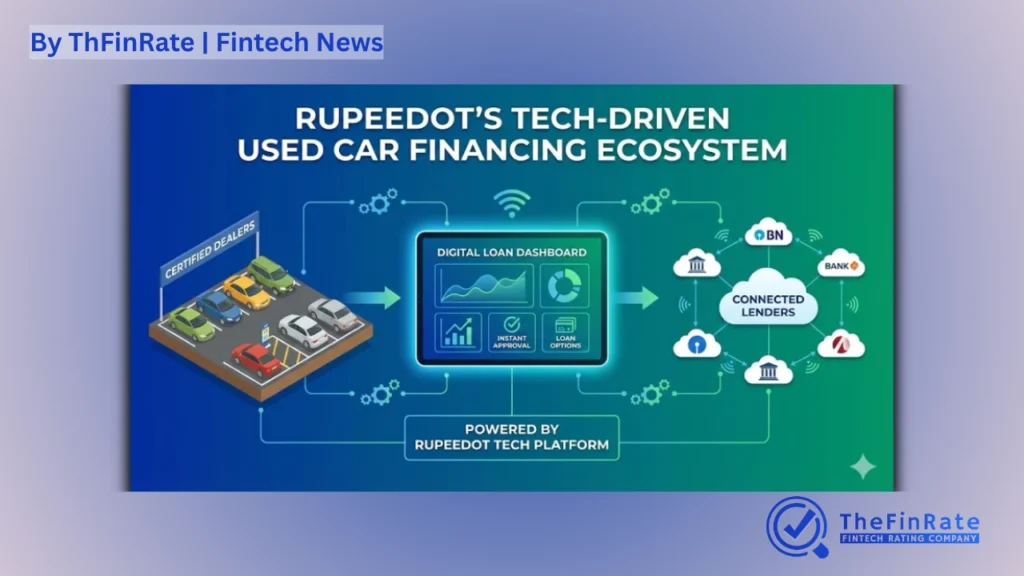

At its core, RupeeDot is reengineering used car financing through data intelligence and automation — addressing both customer and dealer pain points.

1. Intelligent Credit Matching

RupeeDot’s platform uses a mix of traditional and alternative data — including income behaviour, banking history, vehicle profiles, and repayment patterns — to develop a credit scorecard tailored for used car financing. This enables faster, more accurate risk assessment than legacy credit models.

2. Lender-Matching Algorithms

The company is building an intelligent lender-matching engine that evaluates each applicant against specific lender eligibility criteria. This helps match borrowers with financers most likely to approve their applications, reducing unnecessary rejections and improving conversion rates.

3. Dealer-Focused Experience

For dealers, the platform eliminates guesswork. Rather than submitting applications to multiple lenders manually, RupeeDot enables one application → intelligent match → instant pre-approved options — boosting approval speed and dealer confidence at the point of sale.

4. Faster RTO/RC Processing

Recognizing that documentation delays, especially with RTO and RC transfers, can stall conversions, RupeeDot is building solutions to accelerate ownership transfer, further shortening the buyer journey.

Ravish Prasad — with over two decades of auto-finance experience at organisations such as CARS24 Financial Services, Bajaj Finance, Tata Capital, and HDFC Bank — brings deep domain insight and lender relationships to the platform’s execution strategy.

Why This Matters: Financial Inclusion and Market Scale

The low penetration of used car finance represents a structural barrier to mobility and economic participation. With improved access, many first-time buyers, gig workers, and small-business owners — for whom cash purchases are prohibitive — could finally participate in auto ownership, driving both consumption and mobility-led services.

RupeeDot’s model also aligns with broader financial inclusion trends across India, which are pushing credit access deeper into smaller cities and towns through:

- Digitized credit scoring and alternative data

- Automated underwriting

- Inclusive lender networks

- Faster customer onboarding

As financing penetration improves, the used car market — already 1.4x larger than the new car market — could unlock trillions in value, creating opportunities for adjacent services like insurance, fleet financing, and post-sale services.

Conclusion

RupeeDot’s vision is clear: to combine industry experience with scalable technology in order to responsibly serve the millions currently excluded from formal used car financing. By focusing on data-driven credit intelligence, faster approvals, and smarter lender matching, the platform seeks to transform an under-penetrated segment into an inclusive and efficient marketplace.

As India’s used car market accelerates and formal credit expands beyond metros, innovative fintechs like RupeeDot will play a crucial role in making vehicle ownership more affordable, transparent, and accessible — not just a privilege of urban or high-income buyers but a reality for a much wider demographic.