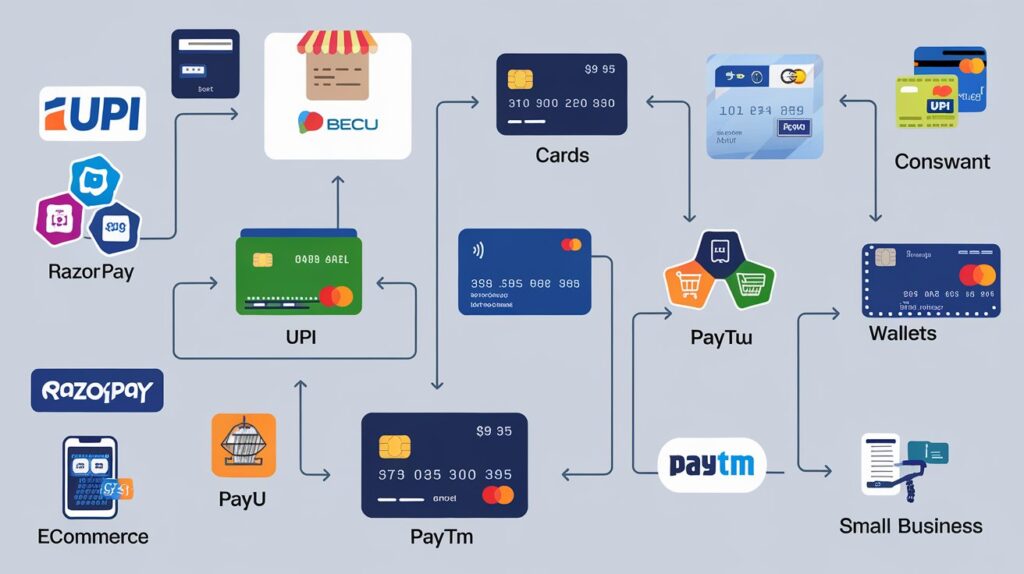

Top Payment Gateway Companies in India

1. Razorpay

Razorpay has swiftly become one of India’s leading payment gateways, known for its user-friendly interface and comprehensive offerings.

Key Features:

- Supports multiple payment modes: Credit/debit cards, UPI, net banking, wallets.

- International payments: Supports 100+ currencies.

- Developer-friendly: Easy API integration for eCommerce platforms.

- Subscription and recurring payments: Ideal for businesses with subscription models.

- Fraud prevention: In-built tools for chargeback and risk mitigation.

Pricing:

- Standard domestic transactions: 2% per transaction.

- International transactions: 3% per transaction.

Best Suited For:

Startups, small businesses, and enterprises requiring subscription models.

Razorpay’s flexibility and competitive pricing make it the go-to choice for businesses across industries in India.

2. PayU

PayU is another big player in India’s digital payments space, known for its versatility and widespread usage.

Key Features:

- Variety of payment methods: Cards, UPI, wallets, and net banking.

- Customizable checkout pages: Tailor your checkout process for better customer experiences.

- Fraud prevention: Advanced algorithms for fraud detection.

- Split payments: Ideal for marketplaces where payments need to be divided among multiple sellers.

Pricing:

- Domestic transactions: 2% per transaction.

- International transactions: 3% per transaction.

Best Suited For:

Medium to large enterprises, as well as marketplaces.

PayU stands out for its enterprise-focused solutions and is trusted by a range of businesses, including online education platforms, eCommerce giants, and marketplaces.

3. CCAvenue

CCAvenue is one of India’s oldest payment gateways and has built a strong reputation over the years, thanks to its robust infrastructure and feature set.

Key Features:

- Supports 200+ payment options: Cards, UPI, net banking, and wallets.

- Multi-currency support: Accept payments in over 27 currencies.

- Advanced analytics: Detailed reporting and dashboard insights.

- Customizable checkout: Seamless user experience for merchants and customers alike.

Pricing:

- Domestic transactions: 2% per transaction.

- International transactions: 3.5% per transaction.

Best Suited For:

Established businesses and enterprises with high transaction volumes.

CCAvenue remains a popular choice due to its extensive payment options and its ability to handle high transaction volumes for larger enterprises.

4. Instamojo

Instamojo is especially popular with small businesses, freelancers, and solo entrepreneurs due to its simplicity and quick onboarding.

Key Features:

- Instant onboarding: Start receiving payments within minutes.

- No setup fees: Great for small businesses looking to avoid upfront costs.

- Payment links: Ideal for businesses without a website; payments can be collected via shareable links.

- eCommerce integration: Integration with WooCommerce, Shopify, and other platforms.

Pricing:

- Domestic transactions: 2% + ₹3 per transaction.

- No international payments: Instamojo is focused on domestic businesses.

Best Suited For:

Small businesses, freelancers, and non-tech-savvy entrepreneurs.

Instamojo’s simplicity and ease of use have made it a go-to for many small-scale and individual sellers in India.

5. Cashfree Payments

Cashfree Payments is known for its high-speed processing and efficient payout features, making it a favorite for businesses requiring quick settlements.

Key Features:

- Fast settlements: Get your funds settled within 24 hours.

- Bulk disbursement: Disburse payments to thousands of accounts with a single click.

- Payment methods: UPI, cards, wallets, net banking, and pay-later options.

- API integration: Developer-friendly API for custom integration.

Pricing:

- Domestic transactions: 1.75% per transaction.

- International transactions: 3% per transaction.

Best Suited For:

Businesses with a need for quick disbursements, such as eCommerce platforms or logistics services.

Cashfree Payments has carved out a niche among businesses requiring high-speed transactions and efficient payout mechanisms.

As part of the Paytm ecosystem, the Paytm Payment Gateway allows businesses to tap into Paytm’s vast user base for quick and seamless payments.

Key Features:

- Wide acceptance: Accept payments via Paytm wallet, UPI, cards, and net banking.

- One-click payments: Paytm users can pay instantly with saved payment details.

- Subscription billing: Ideal for businesses with recurring payments.

- User-friendly dashboard: Track payments and analytics effortlessly.

Pricing:

- Domestic transactions: 1.99% per transaction.

- International transactions: 3% per transaction.

Best Suited For:

Businesses targeting mobile-savvy users and those already leveraging Paytm as a payment option.

Paytm’s seamless integration with its wallet makes it an attractive option for businesses looking to cater to India’s growing base of digital payment users.

7. PayKun

PayKun is a rising star in the Indian payment gateway space, known for its affordability and user-friendly features, catering particularly to small businesses and startups.

Key Features:

- No setup fees: Perfect for startups and small businesses looking to minimize costs.

- Multiple payment methods: Supports UPI, debit/credit cards, wallets, and net banking.

- Developer-friendly API: Easily integrate PayKun with your website or mobile app.

- Dedicated support: Offers 24/7 customer support to resolve queries and issues promptly.

Pricing:

- Domestic transactions: 1.75% per transaction.

- International transactions: 3% per transaction.

Best Suited For:

Startups, NGOs, small businesses, and freelancers looking for an affordable, easy-to-use payment gateway.

PayKun stands out with its competitive pricing and wide payment options, making it an excellent choice for small-scale businesses seeking hassle-free digital payment solutions.

Zaakpay is a homegrown Indian payment gateway solution, known for its strong security and ease of integration, making it an excellent choice for both startups and established businesses.

Key Features:

- Wide payment options: Accepts payments via UPI, cards, net banking, and wallets.

- Fast integration: Developer-friendly API for quick and seamless integration with websites and apps.

- Secure transactions: PCI-DSS Level 1 certified to ensure the highest level of security.

- Real-time reporting: Detailed analytics and insights to track transactions and performance.

Pricing:

- Domestic transactions: 2% per transaction.

- International transactions: 3.5% per transaction.

Best Suited For:

Small and medium-sized businesses, eCommerce platforms, and subscription services.

Zaakpay offers an ideal solution for businesses looking for a secure, reliable, and easy-to-implement payment gateway, with support for diverse payment methods.

BillDesk has long been a staple in the Indian payment gateway market, offering secure and scalable solutions for businesses of all sizes.

Key Features:

- Wide payment options: Supports UPI, cards, wallets, and net banking.

- Robust scalability: Handles large transaction volumes for enterprises.

- Reliable settlements: Regular and timely settlements ensure smooth cash flow.

- Fraud management: Strong fraud detection tools to reduce risk.

Pricing:

- Domestic transactions: 2% per transaction.

- International transactions: 3% per transaction.

Best Suited For:

Established businesses and enterprises handling a high volume of transactions.

BillDesk’s reliable infrastructure and extensive features make it a top choice for large businesses and enterprises in India.

10. HDFC SmartHub

HDFC SmartHub (formerly HDFC SmartGateway) is one of the most trusted and reliable payment gateways in India, offering a comprehensive suite of payment options with strong security, making it an excellent choice for businesses of all sizes.

Key Features:

- Multiple payment options: Accepts payments through UPI, credit/debit cards, net banking, wallets, and EMI options.

- Robust security: PCI-DSS compliant and 128-bit encryption ensures safe and secure transactions.

- EMI support: Enables EMI options for customers using credit cards.

- Quick settlements: Ensures timely settlement of funds for businesses.

- Integrated banking: Provides businesses with seamless integration with HDFC Bank’s banking services for streamlined cash flow management.

Pricing:

- Domestic transactions: 2% per transaction.

- International transactions: 3% per transaction.

Best Suited For:

Established businesses, retail, eCommerce platforms, and those looking to leverage EMI options for higher-ticket transactions.

HDFC SmartHub is known for its secure, bank-integrated solution, making it a preferred choice for businesses looking for reliable, full-scale payment solutions.

Conclusion

Choosing the right payment gateway company in India depends on several factors, including the nature of your business, transaction volumes, and the types of payments you wish to accept. With solutions like Razorpay and PayU for startups and small businesses, to enterprise-focused platforms like CCAvenue and BillDesk, there’s a perfect fit for every business need. As digital payments continue to grow in India, businesses must stay agile and choose gateways that offer security, scalability, and seamless user experiences.

Frequently Asked Questions (FAQs)

1. What is an international payment gateway?

An international payment gateway enables businesses to accept payments from customers worldwide, ensuring secure transactions.

2. How do I choose the best payment gateway in India?

Consider factors like transaction fees, supported currencies, integration options, security, and customer support.

3. Are payment gateways safe?

Yes, reputable payment gateways follow PCI DSS compliance and use encryption and fraud detection tools to secure transactions.

4. What are the fees for using a payment gateway?

Fees vary but generally include transaction fees, subscription costs, and chargeback fees.

5. Can I accept multiple currencies with a payment gateway?

Yes, most payment gateways support multi-currency transactions, allowing global payments.

By leveraging the right payment gateway company, businesses in India can streamline their transactions and ensure a hassle-free digital payment experience.