Chargebacks serve as an essential mechanism in the digital payments landscape, empowering consumers to dispute charges they believe to be unauthorized, incorrect, or unsatisfactory. But for merchants and payment service providers, chargebacks can be complex, often involving strict timelines, detailed documentation, and potential financial risks. This guide breaks down each stage of the chargeback process, helping both consumers and merchants understand the mechanics behind this crucial but often misunderstood aspect of payment processing.

What is a Chargeback?

A chargeback is a dispute process initiated by a cardholder with their issuing bank, requesting the reversal of a specific transaction on their credit or debit card. Unlike traditional refunds, which are processed directly between the consumer and the merchant, chargebacks involve a third party — the issuing bank — which temporarily withdraws funds from the merchant’s account until the dispute is resolved. The chargeback process ensures consumer protection by allowing customers to challenge fraudulent or erroneous transactions.

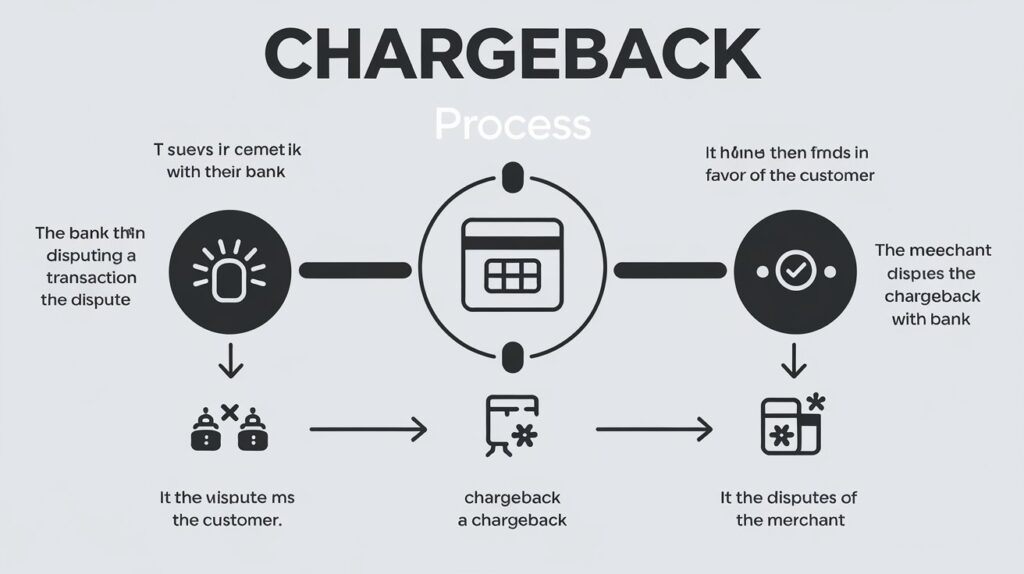

Key Steps in the Chargeback Process

The chargeback process consists of multiple stages, involving communication between the cardholder, the issuing bank, the acquiring bank, and the merchant. Here’s how it works:

Step 1: Dispute Initiation by the Cardholder

The process begins when a cardholder spots a charge they believe is incorrect or unauthorized. They contact their issuing bank to file a dispute. The reasons for filing a chargeback can range from suspected fraud to dissatisfaction with a product or service.

- Common Reasons for Chargebacks:

- Unauthorized Transactions: When a cardholder suspects their card details were used without their permission.

- Billing Errors: Duplicate charges, incorrect billing amounts, or discrepancies in recurring payments.

- Product or Service Issues: Non-delivery of goods, damaged products, or services not rendered as promised.

- Friendly Fraud: Occurs when a legitimate transaction is disputed, often due to misunderstanding or unintentional error.

Step 2: Temporary Funds Reversal

Once the issuing bank receives the dispute, it performs a preliminary review to confirm that the chargeback request is valid. If valid, the issuing bank initiates a temporary reversal, withdrawing funds from the merchant’s account and crediting it to the customer. This step ensures that the consumer is protected while the dispute is further investigated.

- Hold on Merchant’s Account: During this time, the merchant sees a reduction in available funds, as the amount of the transaction is withheld until the case is resolved.

Step 3: Chargeback Notification to the Merchant

The acquiring bank, which manages the merchant’s account, notifies the merchant of the chargeback. This notification usually includes details of the dispute, a reason code (specific to each card network) explaining why the chargeback was initiated, and a timeline within which the merchant can respond.

- Reason Codes: Each chargeback has a reason code, assigned by the card network (Visa, Mastercard, etc.), indicating the nature of the dispute. These codes help merchants understand the specific issue and guide them in crafting an appropriate response.

Step 4: Merchant Response (Representment)

The merchant now has a choice: they can either accept the chargeback or dispute it through a process known as representment. If the merchant believes the transaction was legitimate, they can submit evidence to the issuing bank to prove that the charge was valid. This evidence can include:

- Proof of Purchase: Invoices, receipts, or order confirmations.

- Shipping and Delivery Information: Tracking numbers, signed delivery receipts, or courier records.

- Customer Communications: Emails or messages that demonstrate the customer received the product or service as described.

Important Note: Representment requires thorough documentation, and merchants must adhere to the timelines provided by the issuing bank or risk forfeiting their right to dispute.

Step 5: Decision by the Issuing Bank

Once the issuing bank receives the evidence from the merchant, it reviews all information from both the cardholder and the merchant. The bank then makes a decision based on the provided documentation and reason code.

- Outcome Options:

- Chargeback Reversal: If the issuing bank decides in favor of the merchant, the funds are returned to the merchant’s account, and the dispute is closed.

- Chargeback Upheld: If the bank rules in favor of the cardholder, the temporary reversal becomes permanent, and the cardholder retains the refund.

Note: In cases where a chargeback is upheld, merchants may also incur fees or penalties from their acquiring bank.

Step 6: Escalation to Arbitration (if necessary)

If the merchant disagrees with the issuing bank’s decision, they may escalate the dispute to arbitration, where the card network (e.g., Visa, Mastercard) steps in as a neutral party to review the case and make a final ruling. Arbitration is typically the last resort and can be costly, so it’s used sparingly.

- Arbitration Fees: Merchants and issuing banks pay fees to the card network for arbitration. Given these additional costs, arbitration is often reserved for high-stakes or complex disputes where both parties are confident in their position.

Potential Outcomes of the Chargeback Process

The chargeback process can conclude in one of several ways:

- Chargeback Reversal: The merchant successfully proves the transaction’s validity, and the funds are returned to their account.

- Chargeback Acceptance: The merchant chooses not to challenge the dispute, either due to insufficient evidence or the desire to avoid further fees.

- Chargeback Arbitration Ruling: If escalated, the card network’s decision during arbitration is final, and the ruling determines who retains the funds.

Costs and Risks Associated with Chargebacks

While chargebacks serve as a safeguard for consumers, they introduce significant risks and costs for merchants. Key issues include:

- Financial Penalties: Merchants pay chargeback fees ranging from $20 to $100, depending on the processor, with additional penalties for businesses with high chargeback rates.

- Account Termination Risks: Excessive chargebacks (typically over 1% of monthly transactions) can result in merchants being labeled as high-risk, leading to increased fees or account termination.

- Revenue Loss: Merchants lose the original sale amount, any associated goods or services, and may incur shipping costs for physical items.

- Reputational Damage: High chargeback rates may affect a merchant’s reputation with banks, payment processors, and customers, especially if the disputes stem from poor customer service or product quality.

Reducing Chargeback Risk: Best Practices for Merchants

Effective chargeback management involves proactive measures to minimize disputes and streamline responses:

- Use Fraud Detection Tools: Implement tools like address verification systems (AVS), CVV verification, and machine-learning-based fraud detection to flag suspicious transactions.

- Clear Communication: Ensure product descriptions, pricing, shipping times, and refund policies are transparent to customers. Mismatched expectations often lead to chargebacks.

- Descriptor Optimization: Ensure the business name on credit card statements is recognizable to customers, reducing the chances of “unrecognized” chargebacks.

- Detailed Record-Keeping: Maintain organized records of all transactions, receipts, and customer communications to quickly assemble a defense if a chargeback is initiated.

- Responsive Customer Support: Address customer complaints promptly and offer direct refunds or exchanges when possible to avoid unnecessary chargebacks.

Future Trends in Chargeback Management

The chargeback landscape is evolving, with innovations aimed at reducing fraud, improving dispute resolution, and minimizing consumer chargeback misuse. Key developments include:

- Real-Time Dispute Resolution: Some payment processors now offer near-instantaneous dispute resolution tools, allowing merchants and customers to resolve issues without escalating to a formal chargeback.

- 3D Secure 2.0: Enhanced multi-factor authentication protocols help reduce fraud-related chargebacks by verifying customers’ identities at the time of purchase.

- AI-Driven Fraud Prevention: AI and machine learning tools analyze transaction patterns to detect potential fraud, helping merchants proactively avoid disputes.

- Regulatory Developments: Initiatives like PSD2 in Europe and growing data privacy regulations globally are impacting chargeback processes, adding new layers of security and accountability.

Conclusion

Understanding the chargeback process is crucial for both merchants and consumers navigating today’s payment landscape. For merchants, an effective chargeback management strategy can safeguard revenue, enhance customer relationships, and minimize operational disruption. As chargeback trends continue to evolve with technology and regulatory shifts, merchants who invest in fraud prevention, transparency, and efficient dispute resolution will be better positioned to thrive in the dynamic world of digital payments.