Red Flags and Risks in the High-Risk Payments Ecosystem

Executive Summary

The global payments ecosystem is expanding at an unprecedented pace, driven by e-commerce, iGaming, Forex, and adult entertainment industries. As traditional acquirers maintain strict compliance protocols, a parallel ecosystem of “high-risk payment processors” has emerged—companies that promise fast approvals, relaxed onboarding, and global coverage.

While some of these firms offer legitimate services, others operate in grey zones—leveraging regulatory gaps, multiple jurisdictions, and opaque ownership structures. This investigative analysis examines key red flags merchants should identify before partnering with any such provider. Using publicly available data, we also observe SurfGate—a payment processor claiming to serve India’s high-risk market—as a case example of industry patterns that warrant scrutiny.

1. The High-Risk Payment Landscape

High-risk merchant processing caters to industries where chargebacks, regulatory oversight, or reputational concerns are elevated. These include:

- iGaming and betting platforms

- Adult entertainment and webcam sites

- Forex and crypto brokers

- Nutraceutical and subscription-based models

Banks and card acquirers often decline such merchants due to KYC complexity, reputational exposure, and regulatory friction. To fill this void, alternative processors and offshore payment providers position themselves as “specialists,” offering turnkey solutions, multi-currency gateways, and regional payment rails like UPI, SEPA, PIX, and M-PESA.

However, not all are transparent in their compliance framework. Many market themselves as cross-border fintechs while operating without clear licensing, PCI-DSS validation, or legal establishment in the regions they claim to serve.

2. Understanding Red Flags in New Payment Processors

When evaluating a payment processor—especially one catering to high-risk sectors—certain signs can indicate the need for deeper due diligence:

- Contradictory location claims: Offices or legal addresses listed across multiple countries without regulatory traceability.

- Licensing ambiguity: Claims of compliance (e.g., “PCI-compliant”) without verifiable certificates or registration numbers.

- Inconsistent team geographies: Key staff located in different, unrelated countries with unclear company hierarchy or legal domicile.

- Vague website disclosures: Missing Terms of Service, Privacy Policy, or ownership transparency.

- Unrealistic service claims: For instance, UPI processing offered by an offshore or non-Indian entity, despite UPI being restricted to Indian-licensed PSPs and banks under NPCI supervision.

Such inconsistencies don’t automatically equate to fraud—but they raise legitimate compliance questions, especially when involving cross-border fund movement.

3. Case Observation: SurfGate’s Public Profile

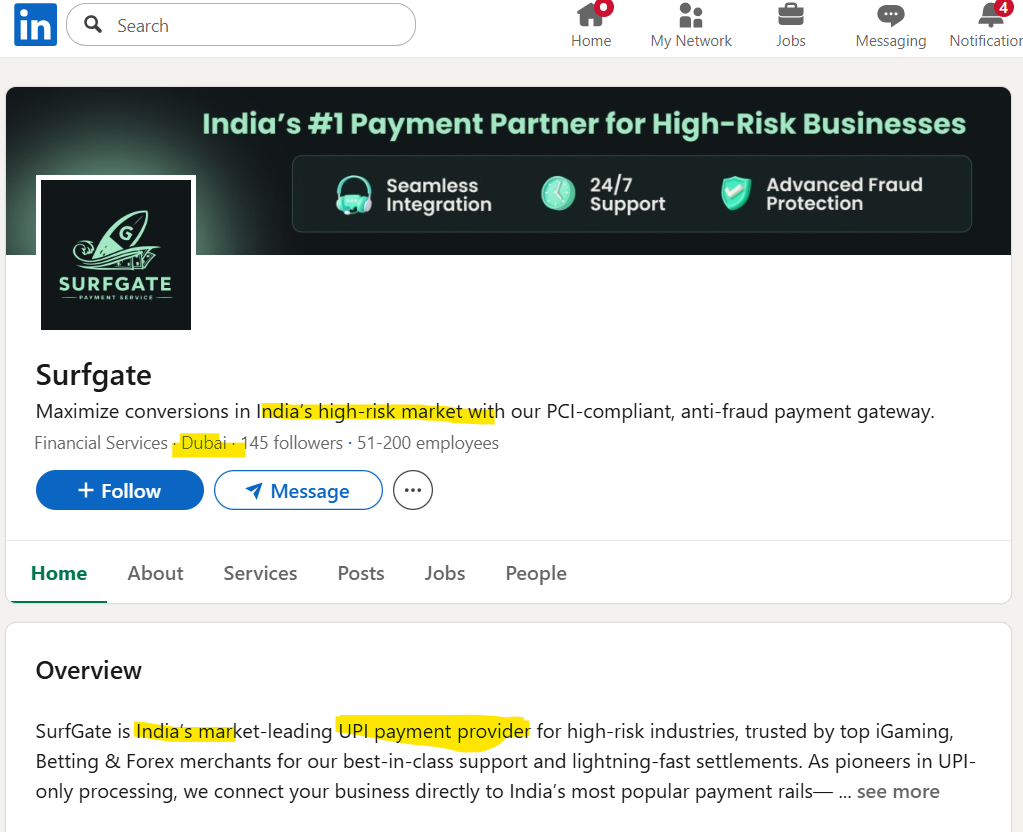

A recent review of SurfGate’s public LinkedIn profile offers a textbook example of why merchants must validate claims independently.

SurfGate’s page describes it as “India’s #1 Payment Partner for High-Risk Businesses”, emphasizing UPI processing, PCI compliance, and anti-fraud systems. Yet, the company is listed under Dubai, UAE, with employees appearing in India and Italy.

One public employee profile identifies their focus on iGaming, Betting, and Forex solutions for Indian high-risk markets—industries that are largely restricted for UPI transactions under India’s regulatory regime.

From a compliance perspective, these points create questions:

- If headquartered in Dubai, how does SurfGate offer direct UPI access (which requires partnership with an Indian-licensed PSP or bank)?

- Is the processor an authorized intermediary under NPCI or RBI frameworks?

- What entity holds custody or settlement responsibilities for Indian merchant transactions?

No official corporate registration or licensing details were visible in standard UAE registries or Indian MCA (Ministry of Corporate Affairs) databases as of this report’s drafting.

These gaps illustrate a broader pattern observed in many high-risk processors—leveraging India’s payment branding (UPI, PayNow, Rupay) while operating offshore without regulatory jurisdiction.

4. Risks of Cross-Border Ambiguity

Cross-border payment processors often position themselves as “global fintechs,” yet the absence of clarity around legal domicile, acquirer partnerships, and transaction settlement pathways can expose merchants to severe operational and reputational risks:

- Fund withholding: Offshore processors can freeze settlements without recourse under domestic law.

- Chargeback liability: Merchants may lack chargeback rights if acquirers or payment facilitators aren’t registered under card network rules.

- AML exposure: Funds routed through layered jurisdictions (e.g., UAE–India–EU) may trigger scrutiny for potential money-laundering links, even if the merchant is legitimate.

- Regulatory penalties: Merchants promoting payment methods like UPI for prohibited industries (e.g., gambling or betting) may face direct regulatory action under Indian law.

5. The UPI Misrepresentation Problem

Unified Payments Interface (UPI) is India’s fastest-growing digital payment rail, built and governed by the National Payments Corporation of India (NPCI). Its use is limited to domestic transactions involving banks and PSPs licensed under the Reserve Bank of India (RBI).

Therefore, any foreign entity advertising “UPI payment solutions for high-risk industries” must be evaluated critically. Offshore firms cannot natively process UPI transactions unless acting through a licensed Indian partner—whose credentials must be publicly verifiable.

The growing misuse of “UPI integration” claims among offshore processors is not just a marketing exaggeration—it risks misleading merchants into non-compliant payment flows.

6. Regulatory and Compliance Gaps

Regulators globally face challenges tracking entities that operate virtually, advertise across multiple jurisdictions, and shift branding frequently.

- In India, payment aggregation is governed by the RBI’s Payment Aggregator (PA) Framework, requiring licensing and net worth standards.

- In the UAE, fintech licensing is overseen by VARA, DFSA, and CBUAE, depending on the service type and free zone.

- In the EU, firms must adhere to PSD2 regulations and register as Payment Institutions (PIs) or Electronic Money Institutions (EMIs).

When a company claims to process payments across all three regions but lacks licensing disclosure in any of them, merchants should treat such gaps as significant risk indicators.

7. Merchant Due Diligence Checklist

Before onboarding any payment partner—particularly one offering high-risk or offshore solutions—merchants should follow a structured due diligence checklist:

✅ Corporate Verification

- Search company name in government business registries (e.g., UAE’s DED, India’s MCA, UK’s Companies House).

- Verify physical office existence through Google Maps or registry data.

✅ Licensing and Authorization

- Confirm RBI, NPCI, or card network (Visa/Mastercard) authorizations if UPI or card processing is claimed.

- Request PCI-DSS Attestation of Compliance (AOC) documents.

✅ Settlement Clarity

- Understand where funds are stored and under what jurisdiction.

- Ensure contracts specify timelines, fees, and dispute mechanisms.

✅ AML and KYC Controls

- Ask for AML policy, KYC verification process, and responsible officer details.

- Avoid processors that don’t perform basic merchant screening.

✅ Reputation and Review Audit

- Check LinkedIn staff profiles, review ratings on com or Trustpilot, and assess activity authenticity.

✅ Legal Documentation

- Demand signed agreements, invoice trails, and data protection compliance (GDPR, DPDP, or equivalent).

8. Why Transparency Is the Next Competitive Edge

As fintech matures, transparency—not aggressive marketing—will define sustainable growth. Payment processors serving high-risk industries must balance innovation with governance.

Industry leaders now integrate RegTech tools, AI-driven transaction monitoring, and independent audits to validate compliance. In contrast, unverified entities often rely on buzzwords like “seamless integration” or “instant UPI” without infrastructural credibility.

By encouraging open verification and supporting rating platforms, the fintech community can collectively reduce exposure to shadow operators that exploit regulatory blind spots.

Conclusion

The high-risk payments sector remains a vital, yet volatile, part of global fintech. While companies like SurfGate exemplify how quickly new players emerge with strong marketing claims, merchants must remember that credibility isn’t built on slogans—it’s proven through transparency, licensing, and regulatory accountability.

Before integrating any payment partner, businesses should verify the legal, technical, and ethical foundation of their providers. A single misstep can lead to frozen funds, compliance breaches, or worse—unintended association with illicit financial networks.

The safest path forward is simple: Trust, but verify.

Publisher’s Note

This analysis is published by TheFinRate.com as part of its ongoing Fintech Transparency Series, dedicated to improving visibility, accountability, and due diligence in the global payments industry. All information presented here is based on publicly available data and does not imply wrongdoing by any specific entity.